Save Money with YNAB Categories

Saving money can be a challenge for people. Between all of the bills you have to pay, debt, and other obligations you may have, saving money may be the last thing on your mind. The unfortunate truth is, very few Americans save money for retirement. Don’t even get me started on emergencies either. In a recent study by Bankrate, only 32% of responders can pay for an emergency with savings. The good thing is, we can fix that! With the help of You Need A Budget, we will show you how to save money for an emergency and other goals.

How to Save Money Easily

Saving money doesn’t have to be difficult. Knowing how to save money isn’t something many people are taught, however. It is far too easy to see the paycheck roll in and think that all of it can be used on whatever you want. The fact is, this isn’t sustainable – life has a way of catching up. It’s for this reason that I recommend You Need A Budget so much. It forces you to think about what your money needs to do before you are paid again. Let’s walk through this real quick.

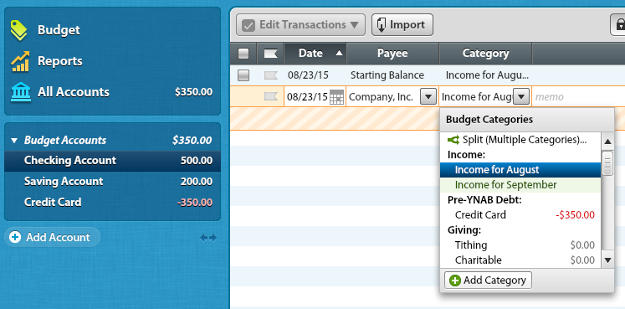

On your payday, enter your income. If you earned $700 for your paycheck, go ahead and enter that. We will go with the assumption that you need it for the current month. Once you’ve done this, you can move to the Budget window and begin creating a plan. Feel free to edit some of the default categories to fit your needs. Let’s take a look at what we have to work with here.

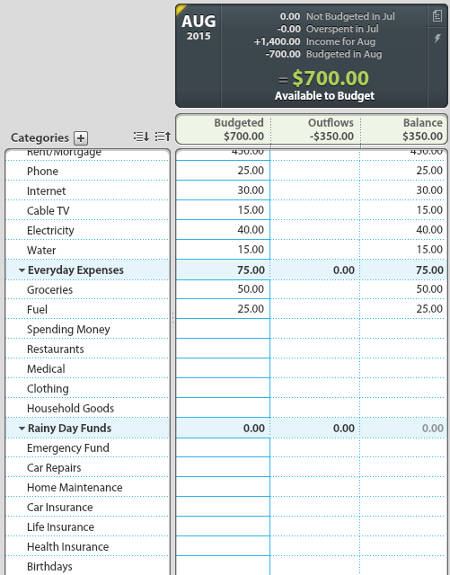

As you can see, we have our work cut out for us. We just entered our $700 paycheck, so that shows as Available to Budget. Without knowing how to save money, this can seem like a daunting task. With the YNAB philosophy though, just enter what you need this money to do before you are paid next. Our current budget has a $0 balance in our emergency fund. This can be dangerous in the event that a medical emergency or an immediate car repair is needed. Let’s go ahead and add $200 to this category. It isn’t much, but slowly we’ll be able to beef this up a bit. By adding this money to the Emergency Fund category, YNAB earmarks this money for a purpose. While most categories are meant to be spent out of, others are meant to be used as containers.

Once we put money into one of the Rainy Day fund categories, YNAB removes it from the money we can budget. This is how we can save money and make our own savings goals. Instead of using your Savings Account balance to track how much you have saved, use the categories to track it. With a savings account, you have one balance to keep track of everything, which can make it difficult to understand how to save money for different goals. With You Need A Budget, the category balances are used to separately track your money. This makes it easy to see your progress on your different saving goals.

The Takeaway

So what should I take away from this? Accurately tracking your savings goals is extremely important to knowing where your money is going. Our internal accounting is usually off by quite a bit, which is why it is important to keep track of your progress. You Need A Budget can help you figure out how to save money more efficiently and keep you on the right track. Emergency funds are an incredibly important saving goal to have and should be one of the first things to save for. Once you have a decent emergency fund, you can then start focusing on paying down debts and saving for other goals!

In the future, we’ll go more in-depth for what your emergency fund should contain and how you should use it. We’ll also be posting about how to pay down debt with the help of You Need A Budget as well. Don’t forget, you can also get a $6 discount on YNAB by using this referral link! Have any tips on saving money or with You Need A Budget in general? Feel free to leave a comment below!