You Need A Budget: An Overview

In the world of budget software, there are many choices. Most offer similar functionality: input transactions, look where your money is going, find where to trim your costs, save where you can. It’s a very predictable pattern. It’s also one that people tend to give up on after a while as it doesn’t make them think about what their money can do for them. In this post, we’re going to look at some budgeting software that takes a new look on how to let your money work for you. All it takes is four simple rules to get started.

The premise is simple. You want to spend your hard-earned money on things you enjoy. A new smartphone that just released, a video game that is receiving great reviews, maybe a down payment for that car you’ve been saving up for. In order to do that, you need to be able to effectively manage where your money is coming from and where you are spending it. Without any sort of real budget that forces you to keep track of this, it can be very challenging. Our minds typically tend to keep separate accounts in our heads, but humans are notoriously bad at keeping up with all those numbers at the same time. This is why we like to think we have enough money for what we want, but when you actually sit down and look at your income and expenses, the opposite is usually true.

What can a budget do for me?

A proper budgeting system in place will help you to keep up with your short-term and long-term goals, as well as have enough money in the bank to pay for bills without having to worry about them. It usually gives you a little bit of wiggle room to play around with for those times when you just have to get that new phone accessory. You may have tried the other methods: the envelope method, writing every transaction in a notebook, manual excel spreadsheets. Chances are, none of them really helped you see the big picture. This is where the program You Need A Budget comes to help out.

You Need A Budget is unlike other software where it’s just a program that looks like a glorified Excel spreadsheet. Instead, the creators provided free live classes to demonstrate You Need A Budget (more affectionately referred to as YNAB), answer any questions you may have, and to also give away a free copy of the software! There are a ton of YouTube videos that have been released by the YNAB team to go over some of the finer details. They also have excellent Support section on their website with many useful articles. A few popular ones are how to handle debt that you have amassed prior to starting with YNAB, how to handle different types of accounts, and many topics. The greatest part of YNAB though is the way that it forces you to think about your money and what you need it to do for you. The way it does that is through what are called the Four Rules.

The Four Rules

So what exactly are the four rules? These rules are the guidelines for how to properly use You Need a Budget to ensure you are on the right track with your money goals. These rules are not just some made up ideas that the creators came up with. They instead are meant to get you thinking about your money not just something you earn and spend, but rather more of a tool to help you do what you want and spend less on things you don’t. Simple! The four rules are as follows:

- Give every dollar a job.

- Save for a rainy day.

- Roll with the punches.

- Live on last month’s income.

These four tenants are massively simplified and we’ll go over them in a bit more detail, but they provide the framework for getting you to a financial state of mind where you are no longer worrying about paying that bill you just received. If you can follow these rules, you’ll be on track to paying down your debts and saving money for your goals in no time. Let’s dive in, shall we?

Rule 1: Give every dollar a job

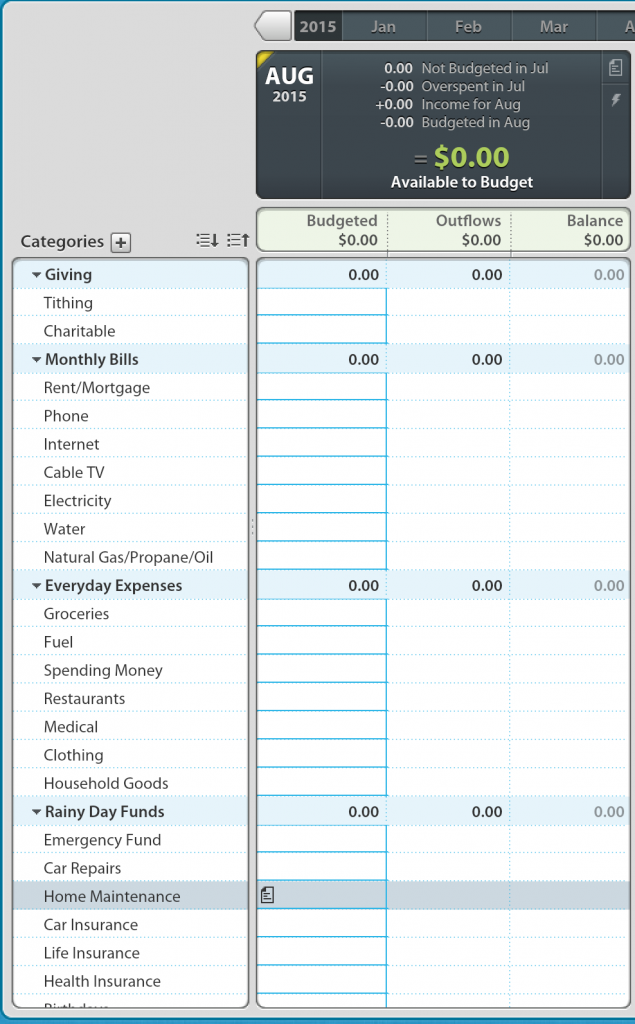

To start with, let’s go over the first rule. Giving every dollar a job may seem counter-intuitive at first. “Where are my savings at?” you may be asking. As far as YNAB is concerned, saving IS a job. All of your money, be it your regular income from your job, birthday money, or even a tax return needs to have some sort of job for it, no matter what. This is one of the primary ways of tracking where we are spending our money. By giving each dollar a job, we are actively telling ourselves what it needs to do before we get paid again. The way we can track this is through the use of categories. These categories are the different areas that we spend our money. The typical bills, groceries, Netflix subscriptions, anything that you spend money on should be categorized.

Your categories should be indicative of things you actually spend money on. Chances are you’ll have a section for your typical bills – rent, electricity, phone, etc. You’ll likely also have your groceries, insurance payments, and other necessary payments. You could also include categories for going out to eat, buying hardware, or even discretionary spending for when you want just a little fun money. Categories for you savings should be in the budget as well.

Once you actually have your categories configured, you need to apply money toward them. This will increase your balance in each category, which is the amount of you are allowed to spend in the categories. Don’t worry if it isn’t totally accurate for the first month or two; chances are you’ll miss some monthly bill that you forgot about. We need to make sure we budget all of our money that is listed in the Available to Budget section in the header of the budget month. Even if some of is dedicated to Savings Goals, we need to make sure the budget is aware of this so we can properly track it. This brings us to YNAB’s second rule.

Rule 2: Save for a rainy day

A rainy day can mean something different for all sorts of people. To some, it means being able to afford an emergency, such as a flat tire that needs to be repaired. For others, it means making sure you have enough money to last a few months in case you lose your job for whatever reason. Saving for a rainy doesn’t have to be just for bad things though. Take, for instance, an insurance payment. Chances are, your insurance provider offers a plan that will lower your overall premium if you choose to pay for a 6 month period as opposed to paying every month. Without knowing that it is budgeted for though, this can seem like a lot of money at once. You Need A Budget offers a different approach to this. Rather than dreading the 6 month payment amount, split the payment into smaller pieces and save for it ahead of time. To do this, you can set a category for your insurance payment, and then add 1/6 of the payment to this category on the first of every month. By the 6th month, you’ll have the money to cover for this and it won’t seem like such a scary payment!

By utilizing Rule 2 in this manner, you were able to save the money you needed over a period of time rather than panic when the bill finally came due. If we weren’t using a budgeting program, we would be doing our funky mind math again. Over a 6 month time period, chances are we would make a mistake somewhere and accidentally spend some of the money that was meant to go to the insurance payment. This doesn’t just have to apply for payments either. This same logic can be applied for any type of savings goals. A down payment for your dream car, a computer upgrade, or even saving for vacation. Whatever your savings goals are, Rule 2 can help you out. A big factor in being able to help save is being flexible too. Rule 3 tells us more about being flexible with our money.