You Need A Budget: An Overview

Rule 3: Roll with the punches

Rolling with the punches is just what it sounds like. If you overspent in a category or missed a category all together, being flexible with our budget can help. Have a stiff budget will only make things worse when trying to regain control of your money. It is important to be able to move things around as needed because things can change at a moments notice. There may be a month where you decide to take a week-long road trip, but only budgeted for $50 in gas money. Chances are, you’ll need more than that, so you can move things around to put more in the gas category and take some out of the spending money category for instance. This flexibility is key to not only helping you understand that sometimes life happens, but also will make you more likely to stay with the program since you can make little changes here and there based on you new needs. The key is not to overdo it. If you are constantly moving money around, you should probably take another look at your current budget setup and figure out what you need to do to update it to reflect reality. The last rule is where things should really kick in. This is where you will begin to notice your stress go down as you aren’t worrying about your money anymore.

Rule 4: Live on last month’s income

Living on last month’s income can be a challenge for many people. If you live paycheck to paycheck, you may find it impossible to get there. If you are able to cut expenses back even by just $15 a month though, you’ll be able to make progress toward ensuring that you are not struggling to make end meets.

Whenever you enter income into You Need A Budget, it asks you if you want to apply it toward this month’s income category or toward next month’s. If you’ve already budgeted for everything this month, keep it for next month! It’ll appear in the Available to Budget header for the following month. If you still have some bills to pay this month and no money left in the budget for it, then categorize it as income for this month. Once you apply it to what you need, make sure to save the rest to roll over to next month. This is to help build what YNAB calls the Buffer. This buffer is what will help make your stress disappear. With a buffer, you able to take the hit of not getting a paycheck on time, missing a day of work due to illness, or any other reason that would cause your income to decrease (hopefully only temporarily). With this buffer in place, you don’t have to worry about where you’ll find the money to pay a bill – you just pay it because it has been budgeted with the money you made last month.

Putting it together

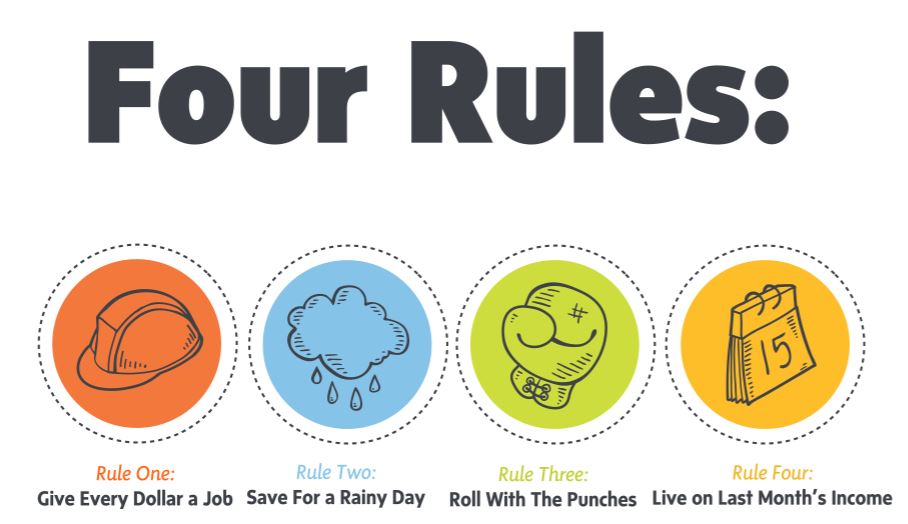

These four rules by themselves are great objectives to shoot for. Put them together and you have a recipe for being able to achieve your goals and have the money to pay for your necessities without worry. Tie in the support and community that YNAB has built, along with their excellent free courses and saving money couldn’t be easier. While there is a bit of time where you may be wondering how it works (especially once you throw credit cards into the mix that have debt on them), in time, everything will work itself out (expect separate posts on how to deal with these things in the future). Even if YNAB isn’t for you, utilizing the four rules together will still help you make great progress toward a solid financial future.

This all sounds great, where can I get it?

So if you like the idea of this program and think it will be of use to you, then keep reading. YNAB offers a 34 day trial period for the program on their website. Why 34 days? This is so that you can see what it would be like to stick with You Need A Budget for over a full month and see how it can help you budget effectively. After the 34 day trial is over, you’ll need to purchase a license. There are numerous ways you can do this. One way is directly on their site. While the price tag of $60 may seem steep, the benefits definitely outweigh the costs. There is also a referral program available that allows you to take $6 off of the cost of the license. You can use this referral link to save some money on the program if you choose to purchase it. It is also available on Steam and has been known to be on sale for as low as $15 during many of Steams larger sales. No matter which way you choose to purchase it, any trial data that you had will continue to work, even if you let the trial expire.

You can also take your budgets with you on your smartphone as well! By syncing your budget files with DropBox, you can access your budget at any time. The smartphone application is a bit limited, however. You can’t make edits to an actual budget (so no moving money around categories unfortunately). You can, however, enter transactions on the mobile app. Since they sync with DropBox, you’ll see the transactions when you login to your computer to see the budget as well. The mobile app can also geo-tag the purchases as well, which makes entering transactions to places you visit frequently super easy!

Final thoughts

Overall, You Need A Budget is a fantastic application that allows people of all types to save money in a much more effective manner than other traditional methods. By adding the Four rules into the mix, YNAB provides a recipe for success for anyone willing to give it a shot. There will likely be a learning curve to go with it, but if you can stick it out, the results will be well worth it. The only suggestion I would have for the YNAB team would be to make the mobile app a more full featured experience. Being able to make actual category changes would be a great feature for people who are using their smartphones more than a laptop or desktop.

Do you use You Need A Budget? Have any thoughts about it? Let us know in the comment section below on YNAB or any other budget method that works for you! Also, be sure to check back for more posts about You Need A Budget and some more in-depth discussions on features that can help you manage your credit card debt, loans, and other savings goals!